P3 Investments continuously tracks various market indicators relating to the risks and opportunities in the Canadian housing market and we wanted to highlight building permits. Given all the media attention, it should come as no surprise that there is a growing supply/demand imbalance in the Canadian housing market. This disparity is largely driven by robust population growth, which is fueled by an aggressive immigration policy, and a housing supply that simply cannot expand at an equal rate.

A CMHC report released in 2023 titled “Housing Shortages in Canada – Updating how much housing we need by 2030” paints a picture nationally that Canada is currently significantly behind pace to keep up with the projected housing demand which is likely to continue to decrease housing affordability. Naturally, the supply/demand imbalance varies from province to province. Of note, Manitoba is projected to have the greatest gap between the projected population housing requirement and the current pace of construction trajectory broadly intensifying demand for rentals.

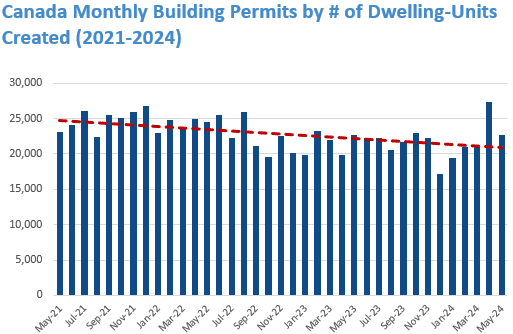

To gauge future housing supply, building permits serve as a very useful indicator. These permits, issued at the municipal level, provide detailed insights into the expected scale and type of housing developments. As leading indicators, building permits offer valuable foresight into the housing market’s ability to meet sustained demand; however, current data shows a worrying trend: the number of building permits issued, measured by dwelling units, has been decreasing significantly.

The graph below, based on Statistics Canada data, illustrates this trend. Since January 2021, when the housing market was building new supply at its peak during the low-interest-rate environment of the COVID-19 pandemic, the number of building permits issued has steadily declined from over 25,000 per month to just over 20,000 per month.

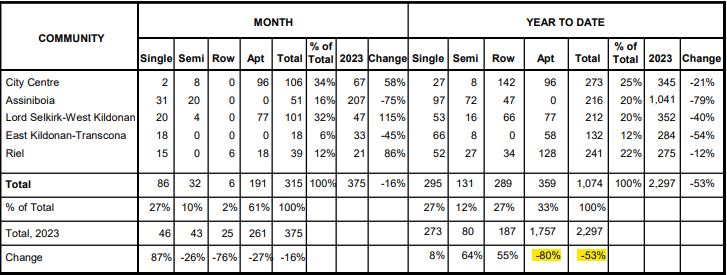

A closer examination of Winnipeg (where P3 is headquartered and has significant real estate investments in apartments) reveals an even more alarming decline. Year-over-year data as of April 2024 shows a 53% drop in building permits, with apartment permits, which constituted the majority of the 2023 figures, plummeting by 80%. To see April’s full building permit summary, click here.

Several factors contribute to this decline, including rising construction costs, normalized higher interest rates, decreased labor productivity, governmental interventions such as rent controls, and prolonged entitlement processes. These factors can collectively challenge the profitability of new developments and commitment of the private sector to make new investments.

For P3, the conclusion is clear: Canada will continue to experience sustained demand pressure on the existing housing supply. Without a significant increase in the housing pipeline in the near future of all types, owners of existing properties will likely benefit from continued high demand for their housing stock.