THE CASE FOR CANADIAN MULTI-FAMILY INVESTMENTS

Diversification of one’s investment portfolio is crucial for long-term financial success, and real estate has long been a popular choice among savvy investors. In recent years institutions, family offices and high-net-worth investors have increased their portfolio allocations to residential real estate. With the current economic landscape uncertain in many regards, we delve into why the Canadian multi-family market remains strong, despite economic uncertainty, and why an investment in multi-family apartments should be considered for one’s portfolio.

A Resilient Asset Class

Fundamentally rental housing has always been a strong asset class across varying economic conditions. Residential real estate in general benefits from the stability that comes from housing being a fundamental need. While different economic situations will cause the demand for office, commercial, industrial etc. to fluctuate, people are always going to need a place to live. In particular, rental apartments are often described as both recession resilient and effective hedges against inflation.

Recent recessions have shown multifamily to be uniquely resilient to macroeconomic volatility. It has historically been the best-performing property type during recessions, with demand remaining relatively strong and rents recovering faster than other property types.1 With housing being a fundamental need, it also means that rent is generally the last expense to go. In tough economic conditions renters will look to cut other discretionary areas of their budget but their need for housing will remain.

Apartments are also considered a strong hedge against inflation. With higher inflation, comes higher mortgage financing costs and more families looking towards renting rather than owning. Typically, as inflation increases, rents are also increasing. The increased rental income also helps drive up the value of the apartment assets as well. Historically multifamily apartments have out-paced inflation due to this rental growth and valuation increase.2

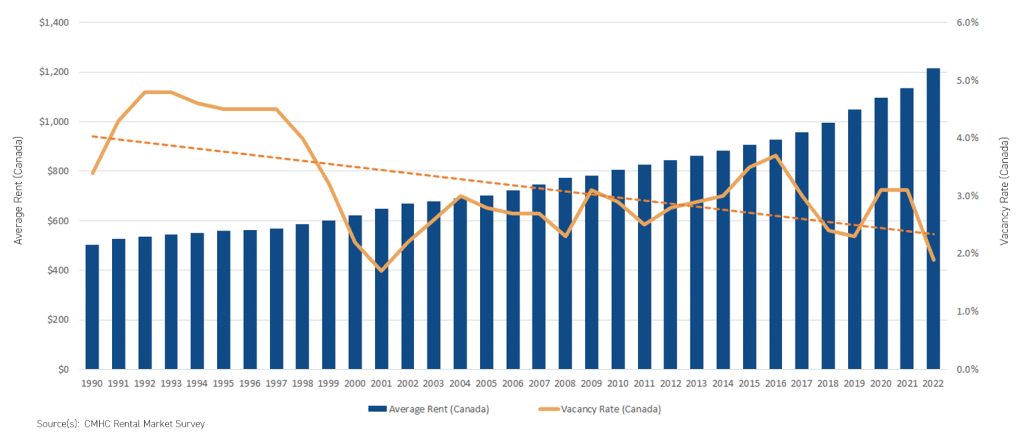

Canadian Rental Market Historical Performance (1990-2022) – Average Rent & Vacancy Rate

Canadian Rental Market Fundamentals: Increased Demand And Constrained Supply

In recent years the demand for housing in Canada has remained strong with rental housing in particular seeing surging demand. Canada’s record immigration numbers largely end up in the country’s rental population as new immigrants (especially students and temporary foreign workers, who make up large swathes of Canada’s new immigrants) are far more likely to rent upon getting settled in a new country. Housing affordability has also eroded to its worst level in more than 30 years, leaving a large part of the population no choice but to rent.3 These factors and several others are driving an extremely robust and growing demand for purpose-built rental housing in Canada.

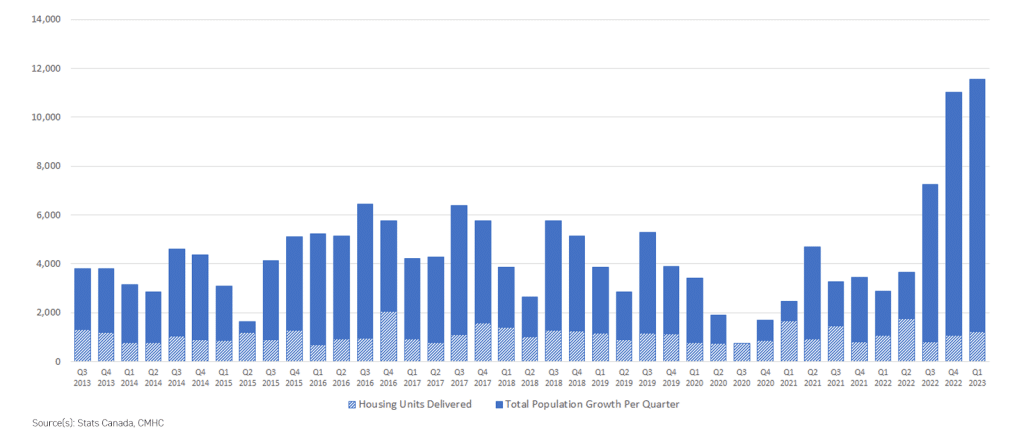

On the supply side of the equation, the Canadian housing market is currently dealing with a massive lack of supply that isn’t looking to go away any time soon. This is a complex and multi-faceted issue that all levels of government are struggling with and with no one solution. Government policies, a slow and inefficient zoning and approvals process, high labor and build costs all contribute to supply not coming close to meeting the demand.

For new purpose-built rental supply in particular the gap between supply and demand is even more pronounced. The lack of new rental supply in Canada is only expected to increase. A recent RBC report found that there is already a 25,000-30,000-unit deficit in Canada’s purpose-built rental stock. By 2026 that deficit could grow to over 120,000 units unless the annual pace of new construction dramatically increases.4

With sky-high demand, combined with a lack of quality supply it’s easy to see why vacancy rates have reached a 20 year low across the country. Investing in an existing portfolio of newly built rental apartments has long term stability given the market conditions facing Canada.

Quarterly Manitoba Provincial Population Growth & Housing Supply Completions (Past 10 Years)

Conclusion

The fundamentals driving the Canadian multi-family real estate market presents opportunities for appreciation and long-term growth for investors and should be a strong consideration for one’s portfolio. Combined with the stability that investing in private multi-family apartments provides against inflation, recessions and volatility, it’s easy to see why savvy investors in both Canada and around the world are holding or increasing their exposure to apartment portfolios.

Well-located multi-family properties in high-demand areas are particularly poised for capital appreciation over time, enabling investors to build wealth over the long-term.

Sources: (1) NAIOP: Multifamily Offers Stability in the Face of Uncertainty; (2) WealthManagement.Com: “Why Multifamily Investments Are a Good Option When Inflation Runs Wild”; (3) Bank of Canada: House Prices and Affordability; and (4) RBC Proof Point: Canada’s shortage of rental housing could quadruple by 2026.